12 Mobile Apps For Managing Your Money & Investments

Financial savviness at your fingertips.

Finances can be tricky to navigate as a millennial. We have subscription services to manage, digital investments to explore, and much to learn about money; it can be downright overwhelming. Luckily, as the world gets more complex, so do the apps that can help sort through the clutter.

It can sound daunting and—let’s be real—kind of boring to start planning and saving for your retirement in your twenties. Do it, though, because your future self will thank you. And stocks can seem like a foreign language spoken by old dudes with pocket watches, but you too can learn to speak the language.

Really, finances are a part of everyone’s lives, so why not make the best of it and invest in yourself? We’ve compiled some of our favorite money apps to help you save, invest, and learn.

—Financial Planning & Management—

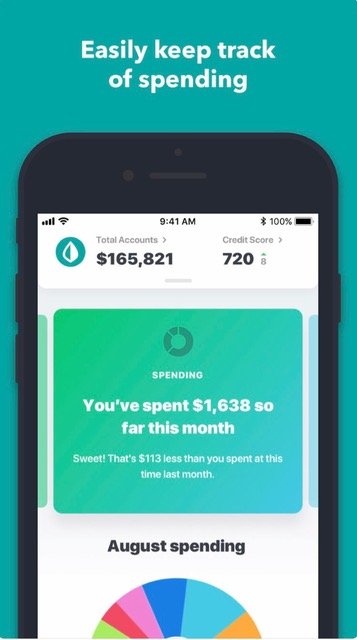

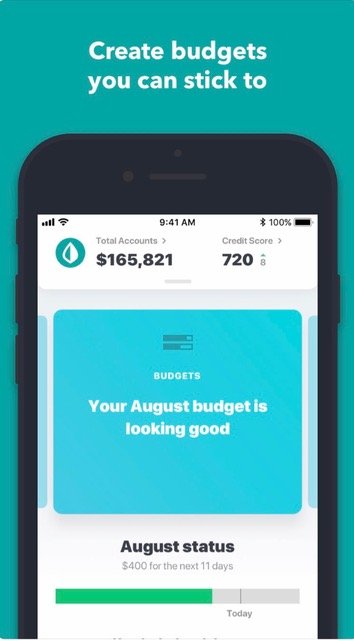

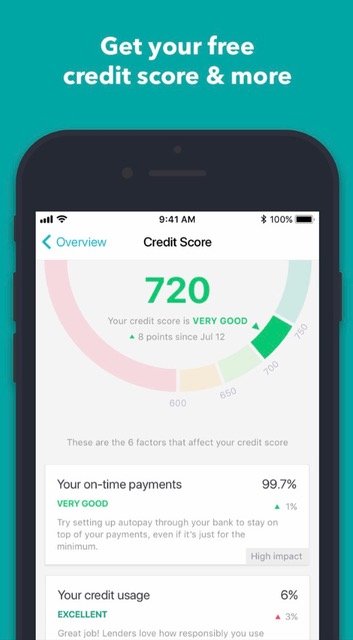

1. Mint

Best For | Budgeting, bills, & managing your credit score

Price | Free

One of the more widely known financial planning apps, Mint is one of our favorites. It’s a one-stop-shop for tracking your bill payments and investments, managing and categorizing your budget, and checking your credit score.

Learn More About Mint

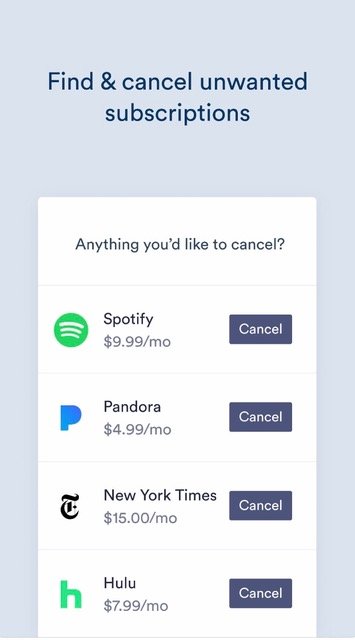

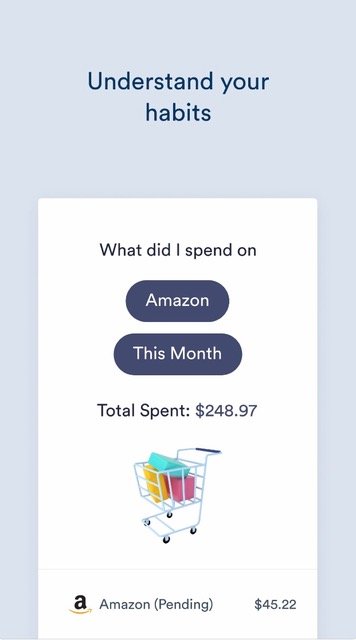

2. Clarity

Best For | Bills & expense tracking

Price | Free

Still subscribed to Hulu even though you swear you cancelled two months ago? Clarity identifies unwanted subscriptions, tracks and categorizes your spending, and even helps you grow your savings since it’s backed by Goldman Sachs’ Marcus, a high-yield savings account.

Learn More About Clarity

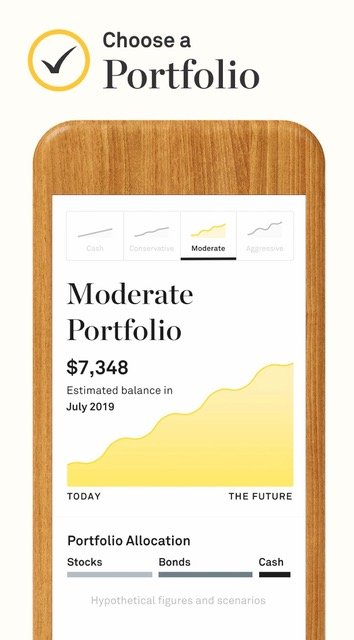

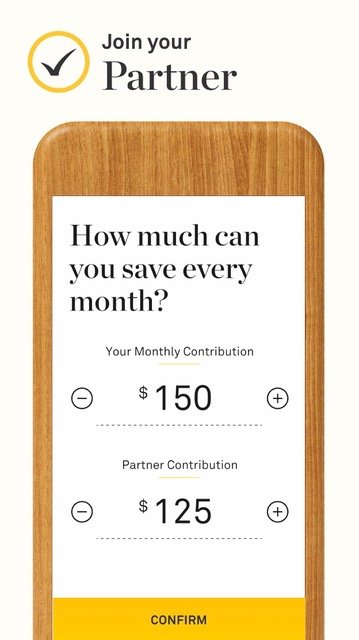

3. Twine

Best For | Saving money with a partner

Price | Free

If you are new to sharing your finances with a partner or are looking to start, Twine is your go-to resource. Built for two, you’ll be able to create a custom goal together, contribute and track progress as a team, and invest in a portfolio or save in cash. Money is one of the biggest argument-triggers between couples—let Twine help alleviate some of that stress.

Learn More About Twine

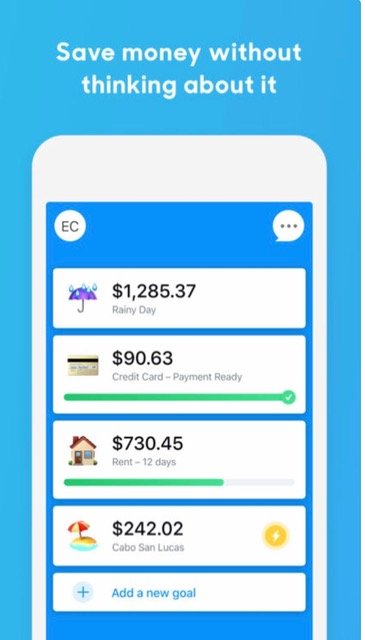

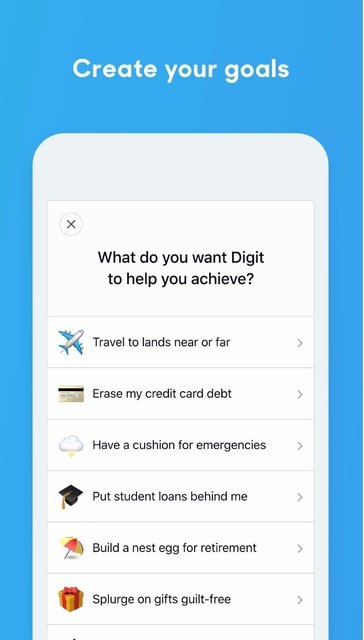

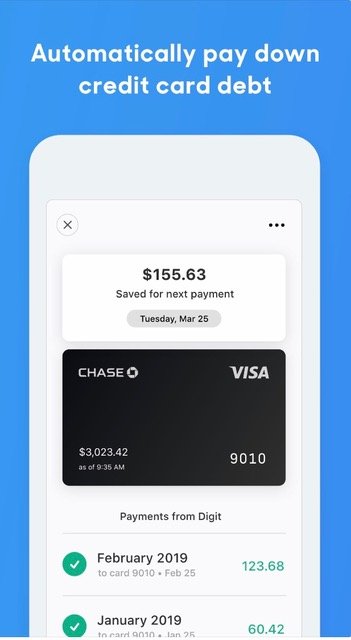

4. Digit

Best For | Automating savings

Price | Free for 30 days, then $5/month

If you want to save but don’t know where to start, check out Digit. Once your share what you’re saving for, Digit’s algorithm learns and analyzes how you spend and automatically saves the perfect amount every day, so you don’t have to think about it. It can help you budget for your dream vacay or for your retirement.

Learn More About Digit

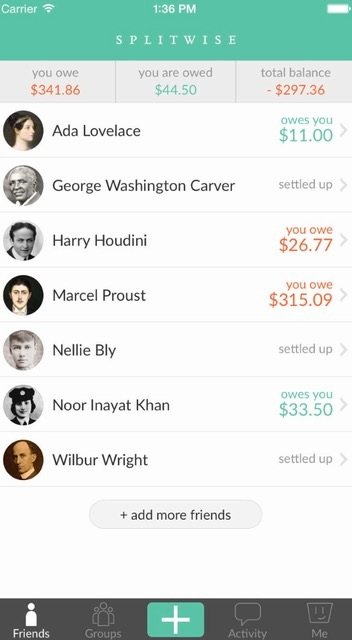

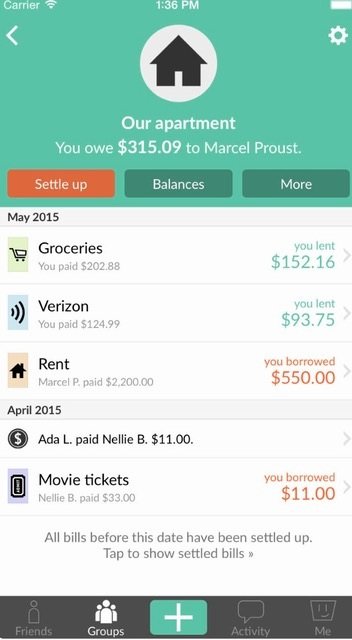

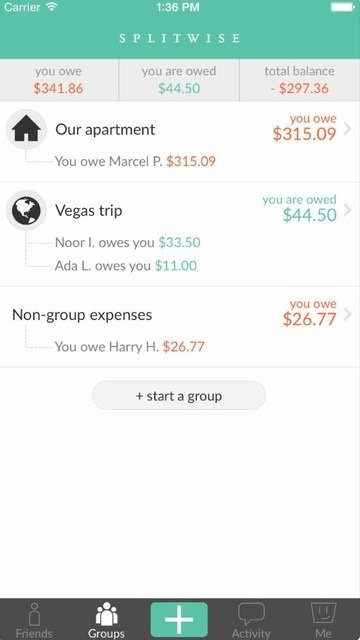

5. Splitwise

Best For | Splitting expenses with friends

Price | Free

There are many awkward moments in life, like when you turn to talk to your friend but it’s actually a stranger standing near you (oops). Splitwise helps take away some of those awkward moments—like asking your roommate to split groceries because they ate your hummus, or splitting an Airbnb for a girls’ trip. The easiest part is it syncs with Venmo and does the hard work for you.

Learn More About Splitwise

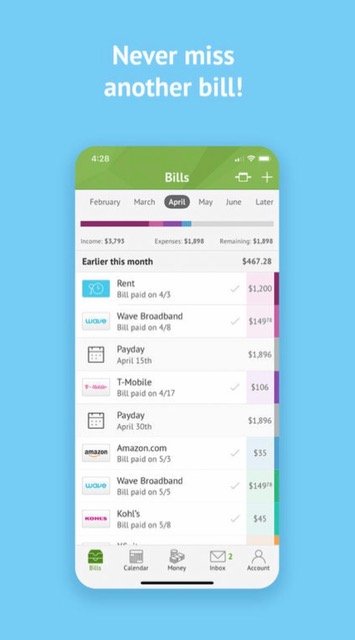

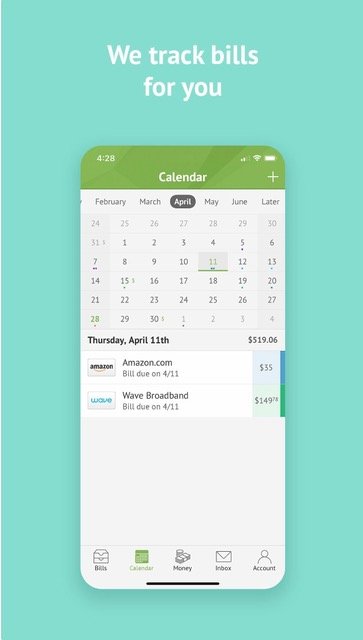

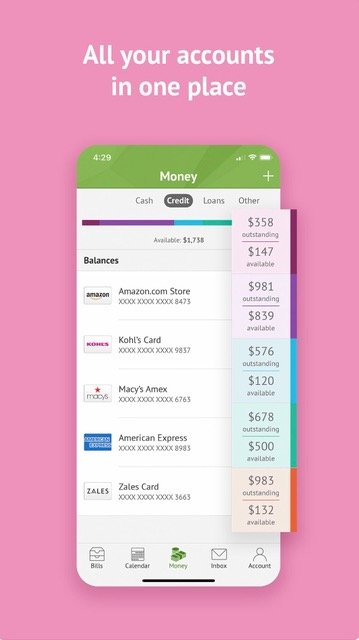

6. Prism

Best For | Paying bills and bill reminders

Price | Free

Prism has more billers than any other app so you can keep track of all your various expenses. It’s visually appealing and user-friendly, and you won’t have to worry about missing any due dates throughout the month; Prism sends you reminders.

Learn More About Prism

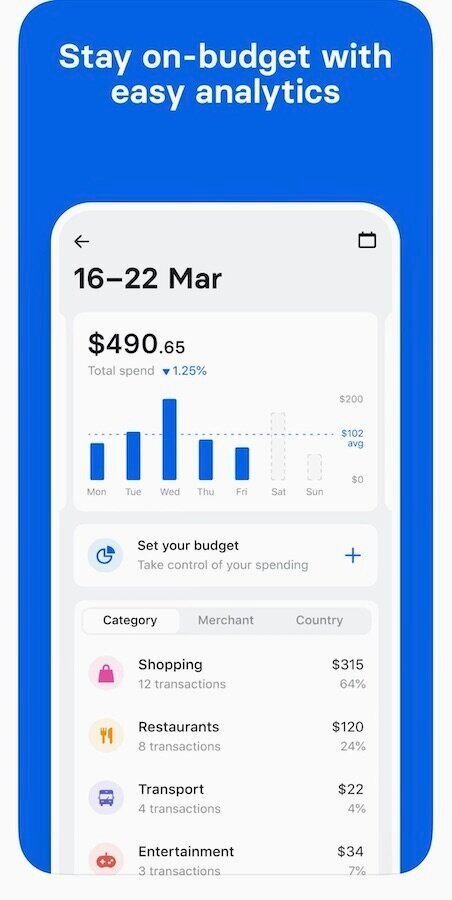

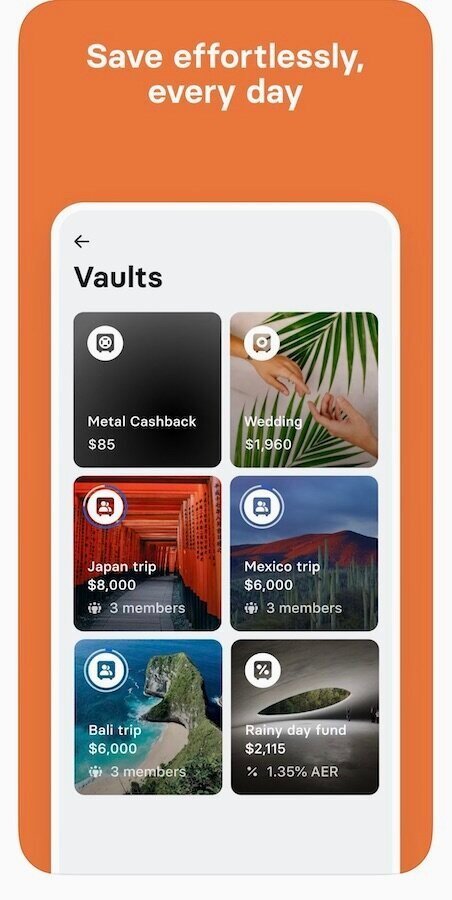

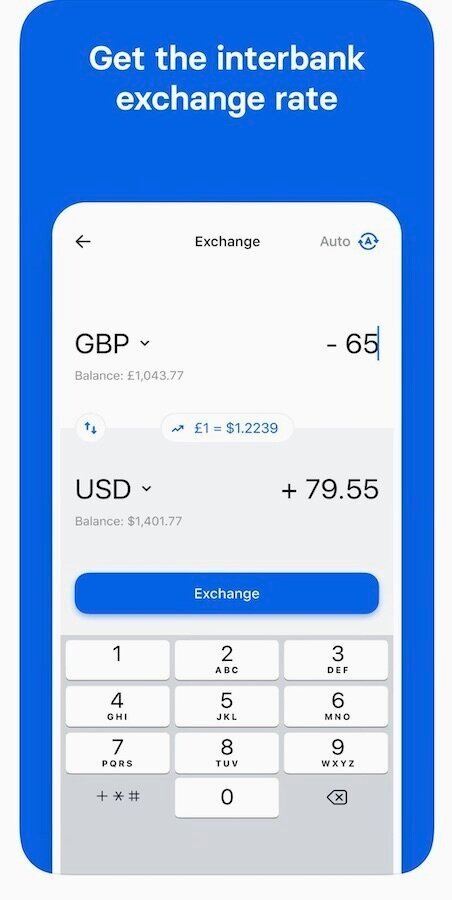

7. Revolut

Best For | International money management

Price | Free (standard); $9.99/month (premium)

Revolut simplifies the process of managing your money internationally. Whether you’re traveling for vacation, temporarily living abroad, or have family overseas, Revolut allows you to exchange, request, send, and receive over 20 currencies, as well as transfer money worldwide with no hidden charges. You can also use the app to set budgets and financial goals, donate to charities, and withdraw from over 55,000 surcharge-free ATMs nationwide.

Learn More About Revolut

—Investing & Self-Educating—

8. Acorns

Best For | Investing, earning, and growing your finances

Price | Free to download, $1–$5/per month for an account

Acorns aims to make investing easy. It helps you start small, by investing spare change from everyday purchases, like your daily iced almond milk latte, but also provides an automated retirement account. PLus, it has original content so you can expand your money knowledge on the go. With these low stakes, it can be a stress-free way to start growing your portfolio.

Learn More About Acorns

9. Stocks

Best For | Stocks and news

Price | Free (comes on an iPhone)

iPhones come with so many specific pre-downloaded apps, it’s easy to forget they exist. The Stocks app should not be slept on, though, if you are interested in learning about the stock market. You can customize your watchlist with stocks, indexes, mutual funds, ETFs, currencies, and more, and then tap any ticker to see price charts for day, week, and month. Following a couple stocks can be a great place to begin before biting the bullet and investing.

Learn More About Stocks

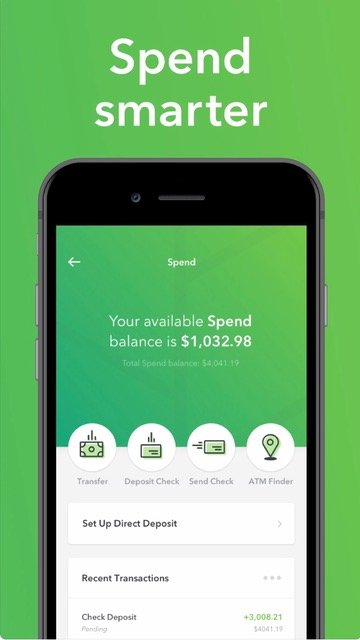

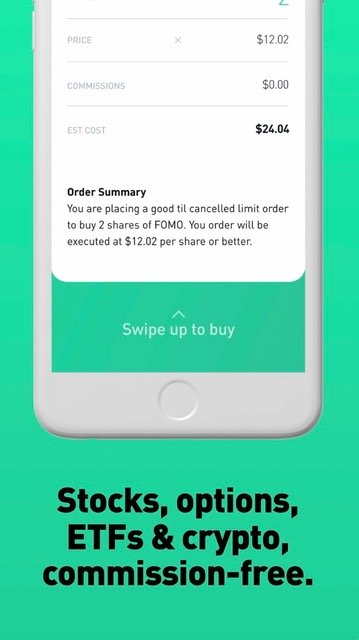

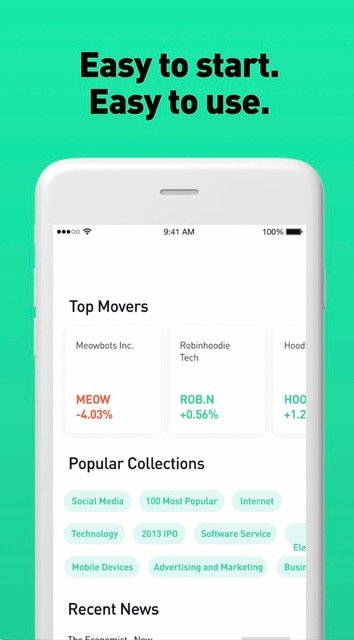

10. Robinhood

Best For | Investing in stocks, cryptocurrency, ETFs

Price | Free

No, not the men-in-tights classic (although that is always worth a watch). The Robinhood app allows you to make unlimited commission-free trades in stocks and ETFs, as well as buy and sell cryptocurrencies with Robinhood Crypto. It also provides fractional shares, meaing you can invest in thousands of stocks with as little as $1.

Learn More About Robinhood

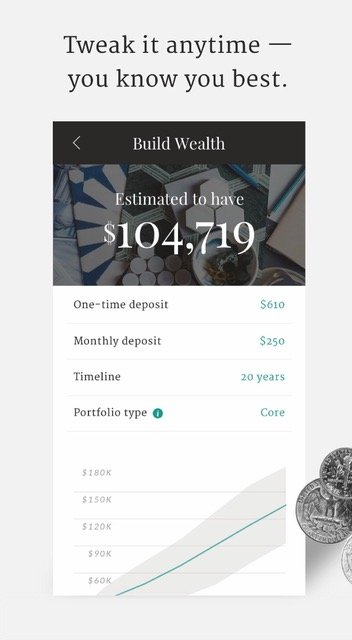

11. Ellevest

Best For | Women-specific investing

Price | Free to download, $1–$9/per month for membership

Finally—a financial app putting women first! Ellevest offers the only investment algorithm tailored to a women’s life, considering factors like pay gaps and longer lifespans. By filling out your profile, it will help you invest based on your specific credentials and goals, and creates a portfolio of stocks, bonds, and alternative funds.

Learn More About Ellevest

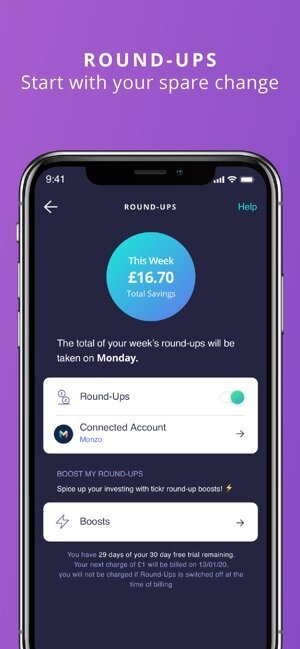

12. Tickr

Best For | Impact investing (UK)

Price | Free

UK-based app Tickr gives you the ability to invest in global companies whose missions are to solve social and environmental problems. You pick your theme (climate change, equality, or disruptive technology), select your risk level, and set the amount you’d like to invest monthly. Expert investors have specifically selected global stocks, shares, bonds, and cash across the market, and Tickr ensures that your money is put into ETFs (with a 0.7% management fee). You can start investing from £5, and can even invest your spare change by rounding up your everyday card purchases to the nearest pound.

Learn More About Tickr

Have any financial apps you love? Let us know below!

Sarah Spoljaric is a California girl through and through. She has a BA in World History from one of the top 10 greenest campuses in the world; The University of California, Merced and is a Content Curator for the visual travel app Trepic. She has a background in museum curating, loves reading women’s travel journals and is in search of the perfect IPA. She’s passionate about exploring this beautiful world that ethically-produced goods help to protect. Say hi on Instagram!